The word compliance alone might make your eyes glaze over, but hear us out. We’ll make it simple, practical, and worth your time. Let’s dive into what compliance is, why it matters, and how to easily get it right.

Put simply, compliance is the process of staying in line with laws, regulations, and industry standards.

Compliance keeps your business safe from risks you don’t want and penalties you can’t afford.

Why companies have compliance programs

The second you finish a background check, the information starts aging. A compliance program bridges the gap between that moment-in-time snapshot and the ever-changing reality of your workforce.

Regulations aren’t optional, and they come at you from three main directions:

- Government agencies – Local, state, and federal laws that dictate how businesses operate.

- Industry regulatory bodies – Standards and rules specific to your line of work.

- Insurance providers – Requirements tied to maintaining coverage and managing risk.

That’s a lot to keep track of, especially when the stakes are high. A compliance program makes sure you’re covered without forcing you to micromanage every detail.

People compliance options

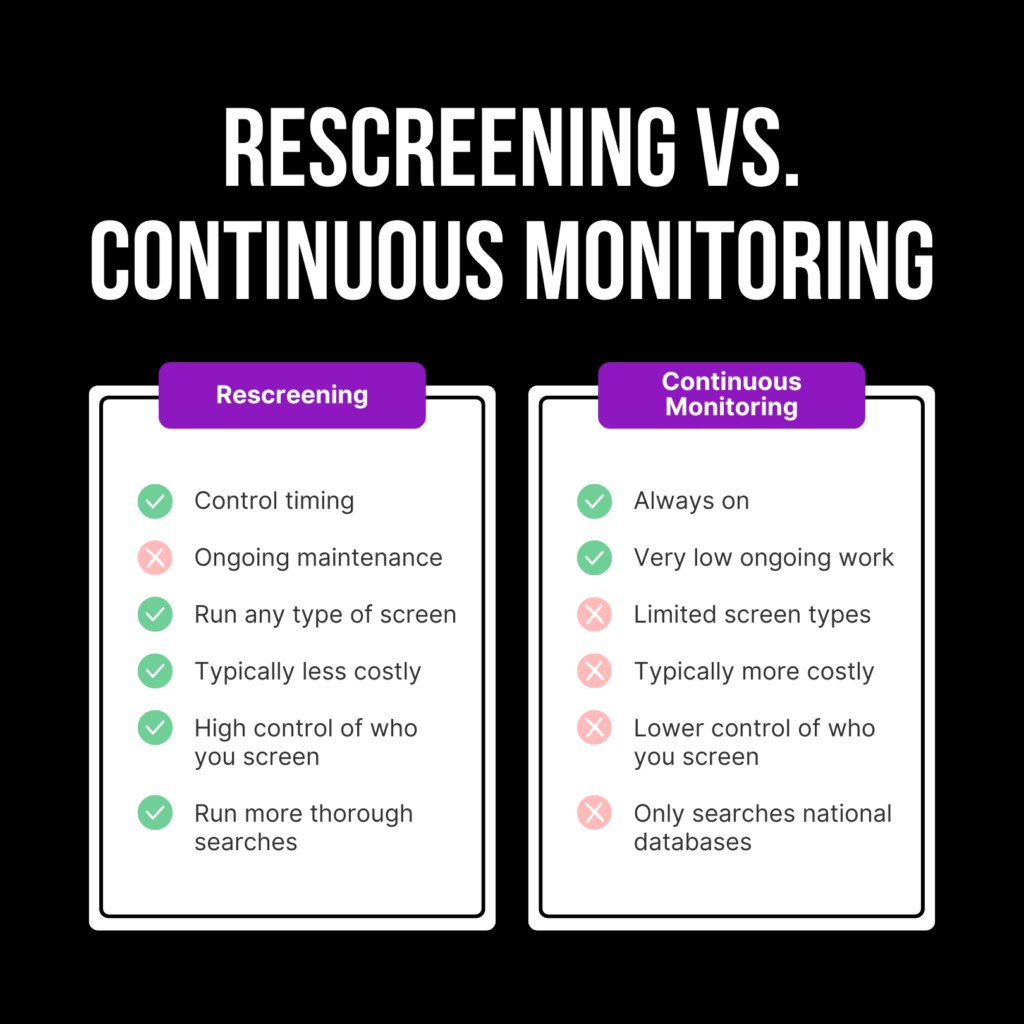

When it comes to keeping your workforce compliant, you’ve got two main options: rescreening or continuous monitoring. Each has its strengths, and the right choice depends on what your business needs. Let’s break it down.

Rescreening

Rescreening is exactly what it sounds like: running a complete background check at set intervals. This could be annual, semi-annual, or whenever there’s a change in someone’s role. For example, if an employee starts managing new customers or steps into a higher-risk position, it might be time for another check.

Here’s why rescreening works for most companies:

- Control timing: You decide when and how often checks happen.

- Run any type of screen: No type of screen is off limits, putting you more in control.

- High control of who you screen: Tailor the intervals and type of screen to each role.

- Typically less costly: It’s usually more affordable than continuous monitoring.

- Run more thorough searches: You can run a broader range of screens, digging deeper when needed.

Like background checks, rescreening only gives you a snapshot of the moment it’s run. If something changes right after, you won’t know until the next check.

Continuous monitoring

Continuous monitoring is the “always on” option. It constantly checks national databases for updates on someone’s record. Once you enroll an employee, it tracks them automatically, alerting you to changes that matter—like a new criminal record.

Here’s where it shines:

- Simplicity: Set it up once, and it runs in the background.

- Always on: Get notified as soon as something changes.

- Very low ongoing work: Fewer steps, less hassle.

But there are limits. Continuous monitoring relies on national databases, which often don’t have the most up-to-date or complete records. County-level information is typically better, but it isn’t included in these systems. Plus, you don’t control the timing—it’s a rolling check based on what’s available. This can make it more expensive and less detailed than rescreening.

Which should you choose?

For companies looking to save money without compromising on quality, rescreening is the better fit. It gives you more control, more options, and deeper insights, all at a lower cost. It’s especially useful if you need to customize your approach for different roles or want a more robust look at someone’s record.

For other companies who place a high value on time or only need national databases searches, continuous monitoring is likely the solution.

The bottom line? Know your needs, weigh the trade-offs, and pick the option that keeps your compliance program lean and effective.

How to start your compliance program

Start small, stay focused, and you’ll be up and running in no time. Here’s how to make it happen:

1. Understand the requirements

Take a hard look at what’s required of your business. Regulations can vary based on your industry, location, and even the roles within your team. Ask yourself:

- What’s legally required? Consult your counsel to see what laws and regulations might apply to you.

- Are there specific standards for my industry? Check with industry associations to see what is expected of companies like yours.

- What does my insurance provider expect? Read through your requirements carefully to make sure you don’t end up in a messy situation.

Knowing where you stand so you can plan accordingly.

2. Start simple (and set a goal)

You don’t need a program that can handle every possible situation on day one. Focus on the essentials and build from there. Decide on your first goal and stick to it. Here are a few examples of goals to get your ideas flowing:

- Reach complete compliance with all requirements for current employees

- Rescreen workers in high-risk roles every six months

- Reach our compliance requirements with only a 5% increase in budget

- Identify compliance metrics and begin monitoring and recording

Think about this as the foundation. Start now, and scaling later will be easy.

3. Pick your path: rescreening or continuous monitoring

By now, you know the pros and cons of each. Choose the option that fits your needs and budget. And remember, you’re not locked into one approach forever. Your needs may change as your business grows.

4. Go!

Don’t overthink it. Once you’ve laid the groundwork, get started. Pick a partner that makes the process straightforward and aligns with your goals. The best programs are the ones that actually happen—not the ones that live in a “planning phase” forever.

Take the first step, and you’ll be ahead of most companies before you know it.

One company’s compliance story, for example

Let’s look at how one of our customers—a massive international restaurant chain—put their compliance program to work.

They don’t just run kitchens; they also have a fleet of drivers delivering food and moving inventory. Their insurance provider had one non-negotiable requirement: keep the driving records of all workers updated or lose coverage. Simple as that.

Here’s how they handled it:

- They chose rescreening over continuous monitoring.

- Every six months, they run Motor Vehicle Record Checks on their drivers.

This approach satisfied their insurance requirements, gave them control over timing, and saved money compared to continuous monitoring.

A compliance program doesn’t need to be complicated to work. It just needs to fit your needs—and maybe keep your insurance company happy while it’s at it.

How to save on people compliance

Compliance doesn’t have to wreck your budget. Here’s how to save without cutting corners:

- Compare costs – Look at rescreening versus continuous monitoring. Rescreening usually costs less and gives you more control, while continuous monitoring works for simple, hands-off setups.

- Pick a modern partner – The right partner can save you time and money. Yardstik, for example, uses modern technology to keep compliance simple and efficient.

- Use Sequential Screening – Only run deeper screens when necessary. This avoids unnecessary costs while keeping your program thorough where it matters most.

Compliance isn’t about doing everything; it’s about doing the right things the right way. Need a partner who gets it? Yardstik is ready to help you build a compliance program that works for your business and your budget. Let’s talk.